It’s a strange time to be alive. A pandemic has the world under lockdown, and the year is filled with economic uncertainty. Yet, with everything that’s going on, there’s one thing that we can be sure of: eventually, things will get better.

To help you get through the in-between, we put together a list of some of our favorite DeFi projects. If you need a brush up on what DeFi is, our team has you covered. So without further ado, let’s begin.

Airswap

Airswap is a decentralized network that enables peer-to-peer trading on Ethereum. The company offers a “no fee,” non-custodial structure, with an easy onboarding for market makers. Check out explorer.airswap.io for data on asset trade volume, assets available, recent swaps, and more.

Compound

Compound is an autonomous protocol that allows users to earn interest on their crypto. It’s an open-source project with tens of thousands of users and dozens of app integrations. The app currently has over $100 million in assets earning interest, and raised $25 million in November 2019.

0x

0x enables peer-to-peer trading of crypto assets on the Ethereum blockchain. The protocol supports all Ethereum standards, including ERC-20 and ERC-721 tokens. It’s free and open-source, providing companies and projects with the tools they need to build next-level trading infrastructure on Ethereum.

Kyber

Kyber is an on-chain liquidity protocol that works to connect projects in the tokenized world. Kyber’s philosophy is to be platform-agnostic, providing instant intertoken transactions, and an easy integration process through a developer-friendly design. The goal of the network is to allow developers to build advanced payment flows and enable decentralized token swaps to be done in any application.

dYdX

DYdX is a decentralized exchange that allows users to lend, borrow, and margin trade Ethereum assets. The company is looking to make high-end financial tools available for everyone, within a secure and transparent financial ecosystem. DYdX is powered by smart contracts on Ethereum, allowing the company to offer users a decentralized marketplace.

Zerion

Zerion acts as a gateway to decentralized finance, allowing individuals and companies to invest in DeFi applications. Its mission is geared towards the developing world, allowing people, regardless of their geographic location, to have access to censorship-resistant and transparent financial infrastructure.

1inch

1inch is a decentralized exchange aggregator. This means that when you go to swap one token for another on the platform, 1inch looks at a host of DEX’s (decentralized exchanges) and sends your order to the one that provides the best price. Want to read more about 1inch? Check out Colin Platt’s review on Decrypt.

TokenSets

TokenSets is all about automated trading strategies put in place to help you manage your digital assets. The project allows traders to put their assets into a “set,” bundling their crypto assets together. Users can then manage their portfolios, either through “robo sets,” or “copy sets.” Robo sets will manage your assets through automated algorithms, while the copy trader functionality allows you to copy the strategies of TokenSet’s top traders.

Uniswap

Uniswap provides automated liquidity on the Ethereum blockchain. The company provides a financially open and accessible marketplace for everyone, drawing in traders, builders, and liquidity providers alike. Uniswap can be used for building oracles, implemented into smart contracts, and much more.

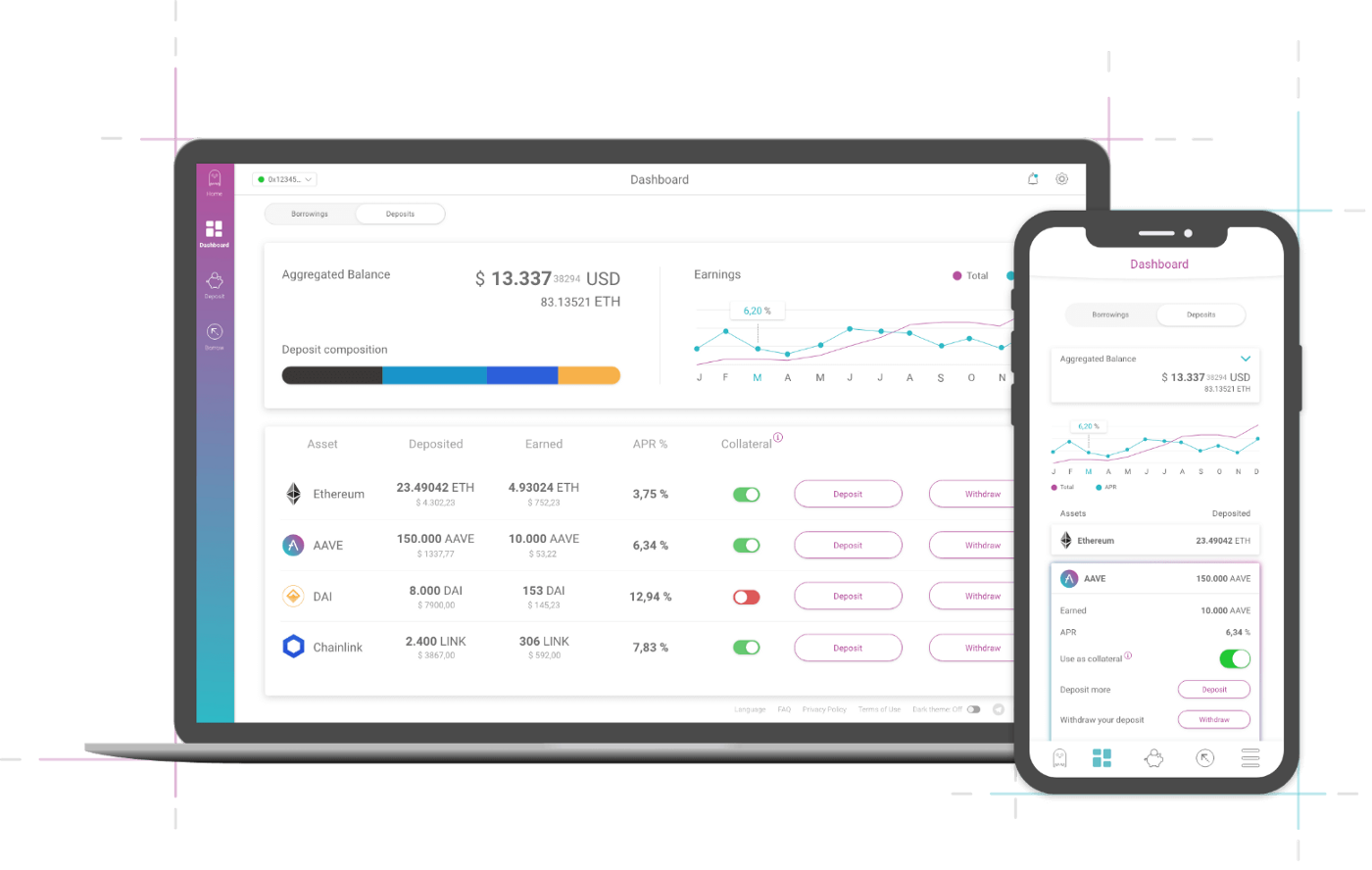

Aave

Aave is an open-source platform that allows you to borrow assets and earn interest on deposits. The company enables flash loans, a quick and easy way to borrow without collateral. When making a deposit on Aave, users receive “aTokens,” a token that is pegged to the underlying asset which they deposited, allowing them to earn interest.

We hope that you’ve enjoyed brushing up on some of the latest and greatest DeFi projects in the space. Think we’re missing one? Let us know!